Nobody likes being in a financial rut, the feeling of helplessness is agonizing because it often appear that the odds are stacked against you. Anybody could end up in a financial mess because of personal errors arising from mismanagement of money or external events such as a job loss, nasty lawsuit, divorce, or sudden economic downturn. However, you can always take proactive action to get your finances back in order irrespective of the factors that led you into a financial rut. This piece looks at four simple tips for getting your finances in good order.

-

Know how deep you are in the mess

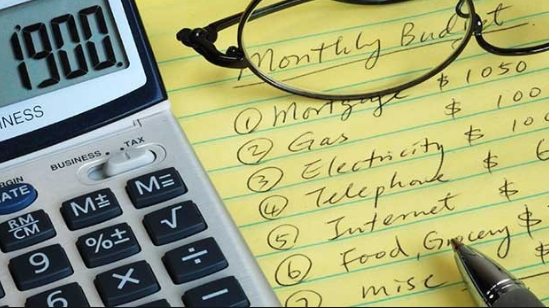

The first step for getting your finances in order to get out of a financial rut is to know how deep you are in the rut. You should stop living in denial and take an honest objective look at the numbers. You need to add up all your debt and liabilities and tally up all your sources of income. You’ll most likely see that your liabilities is way higher than your income but you need to face your fears by the numbers. It is especially easy to be caught up in denial when have a nasty credit card debt spent on consumables. However, the earlier you acknowledge your financial problems, the sooner you’ll be able to make your way out of the rut.

-

Digging a new hole to fill a previous hole is pointless

Consumer debt is real and it is easy to be caught up in the unhealthy lifestyle of living in debt just because you want to keep up with the Joneses. Some folks tend to choose the path of least resistance to ignore calls from creditors while others will look for new loans to pay off old loans in order to “buy more time”. You can start by going in for debt counseling so that you can address the underlying factors that got you into debt. You can also find a strategic debt consolidation program that can help you reorganize your debt profile into a manageable single debt.

-

Start freeing up money from your expenses

The simplest way to get out of a financial rut is to start paying up your debts to reduce the psychological strain and increase your credit score. You can start paying up more of your debt by finding ways to reduce your expenses. If you are in a financial mess with a debt burden hanging over your head, you might want to stop some of the spending habit that got you into debt in the first place. You may want to driver an older model of a car; get a flatmate, cook, and find ways to create awesome “staycations” instead of travelling.

-

Find ways to make more money

You may be able to take a step the right direction to reduce your debt burden if you find ways to make more money. Making more money will make it easier for you to pay down your debts faster. More so, making more money will reduce the need for you to borrow money to fund your expenses in the future. Avenues for earning more money include selling off some of the stuff you don’t (or seldom) use. You can find a second job or work part-time in another job. You can start freelancing or consulting with your skills. You can also find ways to get involved in a side business that can generate passive income for you.